Beware of New Loan Shark SMS Tactics

It seems that with the capping of interest rates charged by Singapore licensed money lenders to 4% per month (effective 1 Oct), the illegal loan sharks (unlicensed money lenders) are feeling the heat and starting to step up their efforts (or rather deceptive SMS tactics) to con unsuspecting victims into borrowing money from them.

Common SMS Tactics

Basically, the loan shark SMS tactics have only one malicious intent – to get you to respond and ultimately take up an illegal loan with them unknowingly. And once you fail to repay the installments, the harrassment will begin.

Here are their 5 most common types of SMS (or WhatsApp/Phone) tactics:

1) Fake Loan Deposited

The sender creates an impression that you are liable for the loan as the money has already been deposited to an account number.

2) Sorry for the Late Reply

The sender assumes the position that your mobile number has already been used to contact them for a loan.

3) Impersonate as Legal Money Lender

The sender masquerades as a licensed money lender in Singapore to instill trust and authenticity in their loan service.

4) Debt Consolidation and Assistance

The sender pretends to be a helpline to assist you in debt consolidation and stopping harrassment from debtors.

5) Reply to a Mobile Number

The sender promises attractive terms such as guaranteed approval and request you to Call, SMS or WhatsApp to a mobile number.

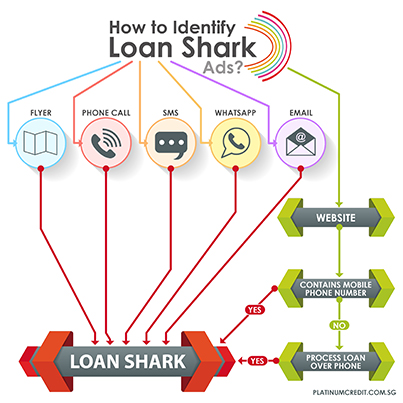

Identify Loan Shark Ads Easily

As the Singapore Government is cautious about encouraging demand through advertising, licensed money lenders in Singapore are only allowed to advertise through these 3 avenues:

(i) consumer/business directories (either online or printed directories such as Yellow Pages);

(ii) websites belonging to the legal money lender; and

(iii) ads placed on the exterior of or within the money lender’s offices.

So if you receive an ad from one of the following channels; referred to a website with a mobile number or promise to process loans over the phone, it is likely from the loan sharks (unlicensed money lender). Because legal money lenders are not permitted to do these.

Why Are Loan Sharks Panicking?

With the interest rate cap, borrowing from a legal money lender has become very affordable. To view an example, visit our online personal loan calculator.

hi karen platinum credit got branch in malaysia or not?

@king, no, we do not have a branch in Malaysia. We believe some loan sharks or scammers are impersonating as us to con others in Malaysia – https://www.platinumcredit.com.sg/2015/12/loan-sharks-impersonating-as-platinum-credit/.

Hi Karen

I have been receiving tons of call from such loan shark and sms , what should I do with this call and most of their call are unknown caller. will the police help ????

@daniel, we believe that these SMS-es/calls are generated from either overseas or through unauthorised prepaid SIM cards. So it is not easy for the authorities to stop them from contacting you. But you can still try to file an online report with the Police here: http://www.police.gov.sg/e-services/report/police-report. In the meantime, you are advised to ignore the SMS-es and block phone calls from unknown callers.

Hi karen. Recently i gave my photo of ic and work permit through whatsapp to an unknown person saying they do loan. Is it possible for them to use my ic and work permit to borrow loan?

Hi Jerome, licensed money lenders like us are ONLY ALLOWED to do loans face-to-face at our office. The unknown person is likely either a scammer or an unlicensed money lender (a.k.a loanshark).